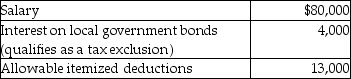

A single taxpayer provided the following information for 2015:  What is taxable income?

What is taxable income?

Definitions:

Pretax Income

Earnings of a company before any tax is applied, calculated by deducting all operating expenses, including cost of goods sold and interest, from revenues.

Curvilinear Costs

Costs that change with the level of output but at a non-constant rate, displaying a curved relationship between cost and output.

Nonconstant Rate

Refers to a rate that changes over time, as opposed to a constant or fixed rate which remains the same.

Mixed Cost

Expenses that contain both fixed and variable components, changing in total with the level of activity but not proportionately.

Q12: Erin,Sarah,and Timmy are equal partners in EST

Q15: Richard is a key employee of Winn

Q23: Patricia exchanges office equipment with an adjusted

Q40: During the current year,Jack personally uses his

Q41: The initial adjusted basis of property depends

Q44: If each party in a like-kind exchange

Q58: Jason owns a warehouse that is used

Q65: An individual is considered terminally ill for

Q84: On June 1,2012,Buffalo Corporation purchased and placed

Q92: Hawaii,Inc.,began a child care facility for its