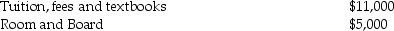

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Self-efficacy

An individual's belief in their capacity to execute behaviors necessary to produce specific performance attainments.

Social Cognitive Theory

A theory in psychology that emphasizes observational learning, imitation, and modeling in understanding behavior.

Applied Behavioral Analysis

A therapy based on understanding and improving specific behaviors, often used for individuals with autism.

Scheme

A systematic plan of action designed to achieve a specific goal.

Q2: Hilton,a single taxpayer in the 28% marginal

Q8: John,an employee of a manufacturing company,suffered a

Q13: An accrual basis taxpayer receives advance payment

Q23: Under the accrual method of accounting,income is

Q28: Aamir has $25,000 of net Sec.1231 gains

Q60: On May 1,2008,Empire Properties Corp.,a calendar year

Q64: Mia is a single taxpayer with projected

Q72: Generally,if inventories are an income-producing factor to

Q102: Alimony is<br>A)deductible by both the payor and

Q108: According to Sec.121,individuals who sell or exchange