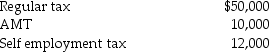

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Word

A word processing software developed by Microsoft, part of the Microsoft Office suite, used for creating, editing, and formatting text documents.

Nonadjacent Items

Items in a list or selection that are not next to each other, often selected using a special method like holding down the "Ctrl" key.

CTRL Key

A modifier key on a keyboard that, when pressed in combination with other keys, activates special functions or shortcuts.

Insertion Point

The blinking cursor in a text document or field that indicates where the next typed character will appear.

Q4: Mattie has group term life insurance coverage

Q8: Regressive tax rates decrease as the tax

Q29: Jennifer made interest-free gift loans to each

Q37: Blaine Greer lives alone.His support comes from

Q38: Generally,in the case of a divorced couple,the

Q42: Gain due to depreciation recapture is included

Q49: Bob owns a warehouse that is used

Q68: An individual who is claimed as a

Q102: Kareem's office building is destroyed by fire

Q128: If a 13-year-old has earned income of