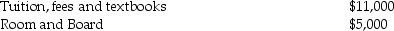

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Source

A company or person who has information to convey during the communication process.

Channel of Communication

Refers to the medium through which a message is transmitted from sender to receiver.

Public Relations Tools

Public relations tools are instruments and methods used to manage and enhance the public image of an individual, organization, or product.

Salesperson

An individual employed to sell products or services to customers, often working on commission and responsible for meeting sales targets.

Q9: Which of the following statements regarding involuntary

Q11: The unified transfer tax system,comprised of the

Q15: Octo Corp.purchases a building for use in

Q20: Any Section 179 deduction that is not

Q21: Stellar Corporation purchased all of the assets

Q26: Jeremy has $18,000 of Section 1231 gains

Q70: The primary liability for payment of the

Q80: In year 1 a contractor agrees to

Q81: John is injured and receives $16,000 of

Q101: Which of the following criteria is not