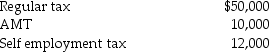

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Loanable Funds

The market where savers supply funds to borrowers, typically through financial intermediaries.

Quantity Supplied

The total amount of a specific good or service that producers are willing and able to sell at a given price, during a certain time period.

Pension Program

A financial arrangement designed to provide individuals with an income when they are no longer earning a regular income from employment.

Real Rate

The interest rate adjusted for inflation, reflecting the true cost of borrowing or the true return on investment.

Q2: Steven and Susie Tyler have three dependent

Q2: Under the terms of a divorce agreement

Q19: This year,a contractor agrees to build a

Q32: George and Meredith who are married,have a

Q38: All of the following are considered related

Q46: If no gain is recognized in a

Q49: Interest is not imputed on a gift

Q53: The standard deduction is the maximum amount

Q96: Atiqa took out of service and sold

Q125: Under the terms of their divorce agreement