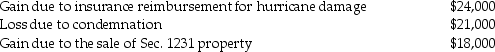

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.  Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

First Amendment

The amendment to the United States Constitution that guarantees freedoms concerning religion, expression, assembly, and the right to petition.

Supremacy Clause

A provision in the U.S. Constitution stating that federal law takes precedence over state laws and constitutions when they are in conflict.

Gas Pipeline

A specialized conduit designed to transport natural gas from its source to its point of use.

Petition the Government

The act of formally requesting or appealing to governmental authorities for a specific cause or action.

Q10: Carolyn,who earns $400,000,is required to pay John,her

Q42: Which of the following is not a

Q54: A corporation is starting to produce watches

Q60: On May 1,2008,Empire Properties Corp.,a calendar year

Q65: When depreciating 5-year property,the final year of

Q74: If a taxpayer's AGI is greater than

Q85: Layla earned $20,000 of general business credits

Q103: In 2015 Charlton and Cindy have alternative

Q106: A taxpayer purchased a factory building in

Q109: Marisa and Kurt divorced in 2013.Under the