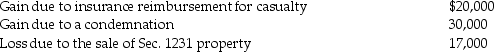

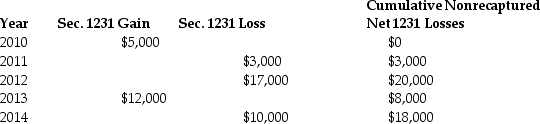

The following are gains and losses recognized in 2015 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.  A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating the percentage of additional income that is paid in tax.

Efficiency

The optimal use of resources to achieve the best possible outcome or output with minimal waste.

Equity

Equity refers to fairness or justice in the way people are treated and involves ensuring equal opportunities and rights for all individuals.

Benefits Principle

A theory in taxation where taxes are apportioned according to the benefits received by taxpayers; those who benefit more from government services, pay more taxes.

Q5: Which of the following advance payments cannot

Q16: A self-employed individual has earnings from his

Q42: On June 30,2015,Temika purchased office furniture (7-year

Q46: Under the terms of their divorce agreement,Humphrey

Q54: A taxpayer may elect to defer recognition

Q55: A sale of property and subsequent purchase

Q60: On May 1,2008,Empire Properties Corp.,a calendar year

Q78: Which of the following benefits provided by

Q84: Ike and Tina married and moved into

Q109: For purposes of the accrual method of