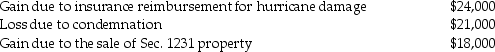

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.  Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Independent Variables

Variables in statistical models that are manipulated or categorized to observe their effect on dependent variables.

Quantitative Predictor Variables

Variables that can be quantified and measured and are used to predict outcomes in statistical analyses.

Indicator Variables

Variables used in statistical models that take the value of 1 if a certain condition is met and 0 otherwise, often used to represent categorical data.

Regression Model

A statistical model used to estimate the relationship between a dependent variable and one or more independent variables.

Q27: Dave,age 59 and divorced,is the sole support

Q49: Tim earns a salary of $40,000.This year,Tim's

Q50: With respect to estimated tax payments for

Q63: Maria,a sole proprietor,has several items of office

Q73: If Jett Corporation receives a charter in

Q76: On November 3,this year,Kerry acquired and placed

Q79: A building used in a business is

Q85: Pierce,a single person age 60,sold his home

Q117: Carlotta,Inc.has $50,000 foreign-source income and $150,000 worldwide

Q131: To qualify as an abandoned spouse,the taxpayer