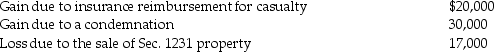

The following are gains and losses recognized in 2015 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.  A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

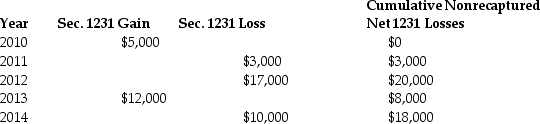

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

United States

A federal republic consisting of 50 states and located primarily in North America, known for its diverse culture and significant global influence.

Consumer Credit

Refers to the variety of financial products available to individuals that allow them to purchase goods or services on credit.

American Consumption

Patterns and behaviors of expenditure on goods and services by households and individuals in the United States.

Steadily Rising Wages

A consistent increase in the amount of money earned by workers over a period of time.

Q1: All of the following transactions are exempt

Q6: Qualified tuition and related expenses eligible for

Q13: When an involuntary conversion is due to

Q25: A fiscal year is a 12-month period

Q29: Tom and Heidi,husband and wife,file separate returns.Tom

Q30: Which of the following is not a

Q59: Julie sells her manufacturing plant and land

Q109: All of the following conditions would encourage

Q113: The recipient of a taxable stock dividend

Q129: Distributions in excess of a corporation's current