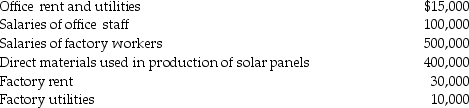

Xerxes Manufacturing,in its first year of operations,produces solar panels which are sold through large building supply and home improvement stores.Xerxes' year-end results include the following:  You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

Definitions:

Futures

Standardized contracts to buy or sell a specific asset at a predetermined price at a specified future date, used for hedging or speculation.

Forwards

A contract between two parties to buy or sell an asset at a specified price on a future date.

Swaps

Agreements to exchange two securities or currencies.

Profiling An Option

This term is not widely recognized in standard financial terminology. NO.

Q7: Gifts between spouses are generally exempt from

Q14: The XYZ Partnership reports the following operating

Q21: Stellar Corporation purchased all of the assets

Q21: A taxpayer's tentative minimum tax exceeds his

Q60: Which of the following taxes is regressive?<br>A)Federal

Q63: Maria,a sole proprietor,has several items of office

Q73: Clarise bought a building three years ago

Q81: Indicate for each of the following the

Q88: Under the cash method of accounting,all of

Q89: If the recognized losses resulting from involuntary