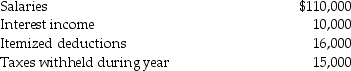

Brad and Angie had the following income and deductions during 2015:  Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Definitions:

Stories

Stories are narratives designed to engage and entertain the audience, often with a structured plot, characters, and a moral or entertainment value.

Facts in Context

Presenting or understanding information or data within its relevant situation, environment, or circumstances to ensure accurate comprehension.

Organize Messages

The act of arranging or structuring communication in a clear and coherent manner to ensure effective conveyance of information.

Pattern

A repeated decorative design or a regular and intelligible form or sequence discernible in the way in which something happens or is done.

Q19: This year,a contractor agrees to build a

Q27: If a new luxury automobile is used

Q30: In August 2015,Tianshu acquires and places into

Q31: A partnership has one general partner,Allen,who materially

Q43: Personal property used in a rental activity

Q62: Identify which of the following statements is

Q83: Under the general liquidation rules,Missouri Corporation is

Q90: Explain the difference in tax treatment between

Q101: Sec.1245 applies to gains on the sale

Q109: For purposes of the accrual method of