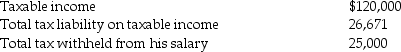

Frederick failed to file his 2015 tax return on a timely basis.In fact,he filed his 2015 income tax return on October 31,2016,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2015 return:  Frederick sent a check for $1,671 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2015.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,671 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2015.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Partial Reinforcement

A conditioning schedule in which a response is sometimes reinforced, leading to more resistant behavior to extinction than continuous reinforcement.

Continuous Reinforcement

A reinforcement schedule in which a reward follows every correct response, often used to establish or strengthen new behaviors.

Operant Conditioning

A training mechanism that adjusts the vigor of an activity by the addition of incentives or the imposition of penalties.

Immediate Reinforcement

The immediate reward or punishment following a behavior, which influences the likelihood of that behavior being repeated.

Q1: Identify which of the following statements is

Q5: A newly married person may change tax

Q17: In an involuntary conversion,the basis of replacement

Q32: Gee Corporation purchased land from an unrelated

Q34: Toby Corporation owns 85% of James Corporation's

Q35: Dan purchases a 25% interest in the

Q51: Tessa owns an unincorporated manufacturing business.In 2015,she

Q74: Identify which of the following statements is

Q75: Stan had a basis in his partnership

Q86: Brent is a general partner in BC