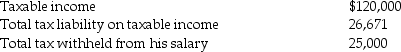

Frederick failed to file his 2015 tax return on a timely basis.In fact,he filed his 2015 income tax return on October 31,2016,(the due date was April 15,2015)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2015 return:  Frederick sent a check for $1,671 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2015.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,671 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2015.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Consumption

The action of using goods and services to satisfy needs or desires.

Income

Receipts from labor or investments, typically disbursed at regular intervals.

Consumption

The process by which goods and services are utilized to satisfy human wants, including the use of resources.

Income

The monetary payment received by an individual or household for their labor, investments, or from transfer payments, used to fund consumption and savings.

Q15: Identify which of the following statements is

Q27: All of the following are true except:<br>A)A

Q36: If related taxpayers exchange property qualifying for

Q46: Charlie makes the following gifts in the

Q49: Interest is not imputed on a gift

Q55: Sec.1250 requires a portion of gain realized

Q73: Which of the following entities is subject

Q77: In a nontaxable reorganization,shareholders of the target

Q82: Under the MACRS rules,salvage value is not

Q93: If the majority of the partners do