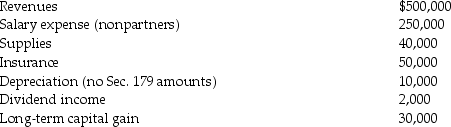

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Quickly

Done with speed or in a short amount of time.

Psychosexual Development

A Freudian theory describing how personality develops in stages (oral, anal, phallic, latent, and genital) through the resolution of conflicts centered on erogenous zones.

Sigmund Freud

A founding figure in psychoanalysis known for his theories on the unconscious mind, the development of sexuality, and the Oedipus complex.

Havelock Ellis

A British physician and psychologist known for his studies on human sexuality and for being a pioneer in the field of sexual psychology.

Q53: All of the following qualify as a

Q64: If a gain is realized on the

Q74: Foggy Corporation has regular taxable income of

Q81: Bluebird Corporation owns and operates busses and

Q88: Becky places five-year property in service during

Q92: Arthur pays tax of $5,000 on taxable

Q94: In computing MACRS depreciation in the year

Q99: Leonard established a trust for the benefit

Q101: Explain the tax consequences for both the

Q115: At the formation of the BD Partnership,Betty