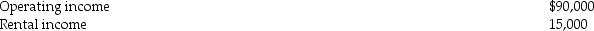

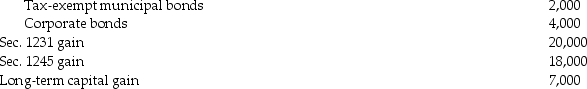

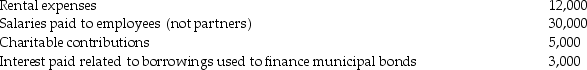

The WE Partnership reports the following items for its current tax year:  Income

Income  Interest income:

Interest income:  Expenses

Expenses  What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Disagreement Signals

Indicative expressions or actions showing a difference of opinion or opposition in a discussion or negotiation.

Localized Infections

Infections confined to a specific body part or region, not spreading to other parts of the body, typically caused by bacteria, viruses, or fungi.

Stable Owner

An individual who owns and manages a stable, providing care and accommodation for horses.

Thinker Personality

A type of personality characterized by analytical, logical, and objective decision-making processes.

Q1: All of the following transactions are exempt

Q6: Andrew sold land to Becca,Andrew's daughter.The fair

Q27: If a new luxury automobile is used

Q33: Larry Corporation purchased a new precision casting

Q38: This year,John purchased property from William by

Q50: A partner's "distributive share" is the partner's

Q76: Vector Corporation has been using an incorrect

Q94: Paper Corporation adopts a plan of reorganization

Q94: Identify which of the following statements is

Q109: For purposes of the accrual method of