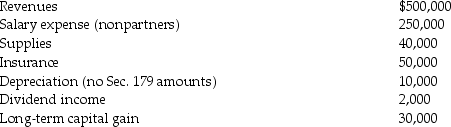

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Perfectly Competitive Industry

An industry in which no single producer can influence the market price of the product because the conditions of perfect competition are met.

Economic Resources

Assets or inputs that contribute to the production of economic goods, including land, labor, capital, and entrepreneurship.

Economic Profits

Profits calculated by subtracting both explicit and implicit costs from total revenue, capturing the true economic value created.

Opportunity Costs

A concept in economics that describes the potential benefits that an individual, investor, or business misses out on when choosing one alternative over another.

Q3: Cardinal and Bluebird Corporations both use a

Q26: Corporations recognize gains and losses on the

Q34: Drury Corporation,which was organized three years ago,reports

Q35: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q37: On the first day of the partnership's

Q54: A taxpayer may elect to defer recognition

Q82: What are the three rules and their

Q87: Town Corporation acquires all of the stock

Q98: Theresa owns a yacht that is held

Q102: Mario contributes inventory to a partnership on