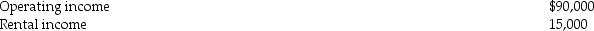

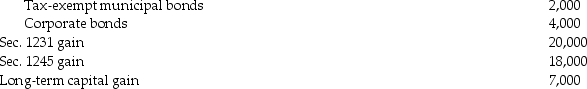

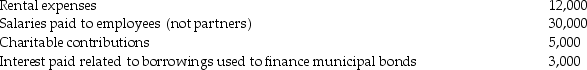

The WE Partnership reports the following items for its current tax year:  Income

Income  Interest income:

Interest income:  Expenses

Expenses  What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Metric

A quantitative measure for a concept or activity—for example, the impact factor in scholarly publishing as a measure of influence.

Anomalous Data

Data points or observations that deviate significantly from the rest of the dataset, potentially indicating errors or novel findings.

Anticipated by the Researcher

Refers to outcomes, findings, or events that the researcher expects to occur or observe during the course of their study based on theoretical or empirical grounds.

Calculating Variance

The process of determining the spread or dispersion of a set of numbers by averaging the squared differences from the mean.

Q6: A shareholder's basis in property distributed as

Q8: Identify which of the following statements is

Q12: Baxter Corporation transfers assets with an adjusted

Q27: Under the accrual method of accounting,the two

Q27: Riverwalk Corporation is liquidated,with Juan receiving $5,000

Q37: Firefly Corporation is a C corporation.Freya owns

Q51: Mick owns a racehorse with a $500,000

Q67: Johnson Co.transferred part of its assets to

Q82: Identify which of the following statements is

Q91: On December 1,Antonio,a member of a three-person