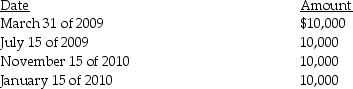

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:  What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Incubation

In the context of creativity and problem-solving, the process of setting aside a problem temporarily, allowing for subconscious thinking to aid in solution development.

Illumination

The process or result of providing or being provided with light.

Emotional Intelligence

The capacity to be aware of, control, and express one's emotions judiciously and empathetically, also understanding the emotions of others.

Relationships

Connections or associations between individuals, governed by social, emotional, professional, or biological factors.

Q17: Identify which of the following statements is

Q21: Blair and Cannon Corporations are members of

Q36: A stock redemption is always treated as

Q51: Carol owns Target Corporation stock having an

Q64: Which of the following statements regarding the

Q69: The acquiring corporation does not recognize gain

Q76: Checkers Corporation has a single class of

Q84: Formation of a partnership requires legal documentation

Q103: Jason,a lawyer,provided legal services for the employees

Q121: Cherie transfers two assets to a newly-created