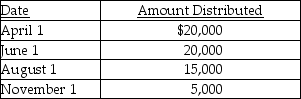

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Date of Acquisition

The specific date on which one company gains control over another entity or asset, crucial for accounting and legal purposes.

Consolidated Common Stock

Consolidated common stock refers to the aggregation of common stock holdings across a group of consolidated companies, presented as a singular amount in consolidated financial statements.

Par Value

The face value of a bond or the stock value stated in the corporate charter, often used as a legal capital threshold for shares.

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation, with voting rights and potential dividends.

Q3: Cardinal and Bluebird Corporations both use a

Q3: On July 1,in connection with a recapitalization

Q24: A calendar-year individual taxpayer files last year's

Q68: Identify which of the following statements is

Q76: Meg and Abby are equal partners in

Q80: In Fall 1999,Ford Motor Company's board of

Q86: What is the IRS guideline for determining

Q96: The innocent spouse relief provision from tax

Q98: A client asks about the relevance of

Q108: Beth transfers an asset having an FMV