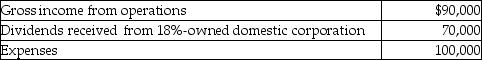

Maxwell Corporation reports the following results:  Maxwell's dividends-received deduction is

Maxwell's dividends-received deduction is

Definitions:

Colorado Rockies

a major mountain range located in the western United States, noted for its stunning landscapes and outdoor recreational activities.

Great Plains

A broad expanse of flat land, much of it covered in prairie, steppe, and grassland, located in the central part of the United States.

Mississippi River

A major river in the United States, flowing over 2,300 miles from its source in Minnesota to the Gulf of Mexico, and playing a key role in the ecology, economy, and history of North America.

Earth's Concentric Zones

Refers to the internal layers of the Earth, which include the crust, mantle, outer core, and inner core, arranged from surface to center.

Q5: Explain how to determine the deductible portion

Q5: The gross-up rule requires<br>A)all beneficial interests be

Q10: Why would an acquiring corporation want an

Q20: Wills Corporation,which has accumulated a current E&P

Q20: A trust that is required to distribute

Q32: A corporation distributes land and the related

Q39: The IRS audited the tax returns of

Q63: Identify which of the following statements is

Q73: Identify which of the following statements is

Q94: Which of the following items will not