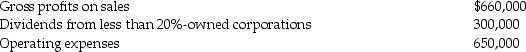

Carter Corporation reports the following results for the current year:  a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Router Platform

A foundational hardware device or software framework that directs network traffic between different networks by managing data paths for efficient communication.

Avoidable Expenses

Costs that can be eliminated if a particular activity or decision is not made.

Unavoidable Expenses

Expenses that cannot be eliminated and are necessary for a business's operations or living expenses.

Business Segment

A part of a company that can be identified by particular products or services or by geographical areas, generating its own revenue and expenses.

Q12: Baxter Corporation transfers assets with an adjusted

Q16: A tax entity,often called a fiduciary,includes all

Q24: For corporations,what happens to excess charitable contributions?

Q44: Identify which of the following statements is

Q51: Identify which of the following statements is

Q75: Corporations may carry charitable contributions in excess

Q84: Carolyn transfers property with an adjusted basis

Q95: Identify which of the following statements is

Q100: The alternate valuation date is generally<br>A)3 months

Q111: Digger Corporation has $50,000 of current and