Essay

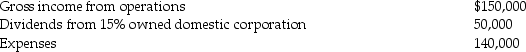

Bebop Corporation reports the following results in the current year:  What is Bebop's taxable income?

What is Bebop's taxable income?

Definitions:

Related Questions

Q1: Market Corporation owns 100% of Subsidiary Corporation's

Q13: Identify which of the following statements is

Q14: When a liquidating corporation pays off an

Q30: Corporate estimated tax payments are due April

Q46: Identify which of the following statements is

Q51: Carol owns Target Corporation stock having an

Q71: Hope Corporation was liquidated four years ago.Teresa

Q83: Under the general liquidation rules,Missouri Corporation is

Q91: A special power of appointment exists if

Q102: How is alternative minimum taxable income computed?