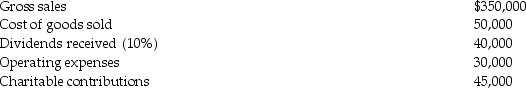

Jackel,Inc.has the following information for the current tax year:  What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

What is Jackel's charitable contribution deduction? What is Jackel's taxable income?

Definitions:

Enactive Mastery

Gaining confidence or expertise in a particular area through hands-on experience and practical engagement.

Self-Efficacy

A belief in one's own ability to complete tasks and reach goals.

Confident

The feeling or belief that one can rely on someone or something; firm trust and self-assurance.

Emotional Arousal

The condition of having one's emotions stimulated or intensified, often leading to specific behavioral responses.

Q33: Splash Corporation has $50,000 of taxable income

Q38: Which of the following is an advantage

Q39: Bright Corporation purchased residential real estate five

Q80: How is the gain/loss calculated if a

Q93: Organizational expenditures include all of the following

Q94: Tomika Corporation has current and accumulated earnings

Q94: The IRS will issue a 90-day letter

Q100: Francine Corporation reports the following income and

Q101: Four years ago,David gave land to Mike

Q107: Identify which of the following statements is