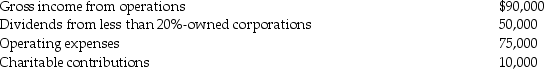

Dexter Corporation reports the following results for the current year:  In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition,Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Definitions:

Prepared Associations

Pre-existing tendencies in animals, including humans, to easily learn certain associations compared to others, due to evolutionary adaptations.

Unprepared

Not ready or adequately equipped to handle a particular task or situation.

Generalized Reinforcer

A reinforcing stimulus that has obtained its reinforcing properties through association with other reinforcers.

Token

An object or symbol that represents a right, fact, or attribute, often used as a means of access or in exchange processes.

Q8: Which,if any,of the following could result in

Q19: Identify which of the following statements is

Q23: Generally,a corporation recognizes a gain,but not a

Q23: Explain how the Internal Revenue Service is

Q34: Bob exchanges 4000 shares of Beetle Corporation

Q36: If the taxpayer has credible evidence,the IRS

Q51: Parent Corporation owns 70% of Sam Corporation's

Q63: Jeremy transfers Sec.351 property acquired three years

Q68: Liquidating expenses are generally deducted as ordinary

Q73: Identify which of the following statements is