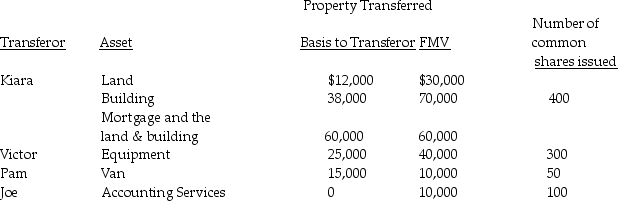

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:  Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Lowballing Technique

A persuasion and sales strategy where an initially lower price is presented to get agreement, only to increase it later on.

Foot-In-The Door Technique

A compliance tactic that involves getting a person to agree to a large request by first setting them up by having them agree to a modest request.

Social Proof

The psychological phenomenon where people assume the actions of others in an attempt to reflect correct behavior for a given situation.

Social Comparison

The method in which people assess their own skills, accomplishments, and situations relative to other individuals.

Q9: In which of the situations below will

Q13: Lily dies early in the current year.All

Q14: Apple Trust reports net accounting income of

Q23: Explain how the Internal Revenue Service is

Q25: Nikki exchanges property having a $20,000 adjusted

Q34: Praneh Patel,a widower,died in March of the

Q45: Paul,who owns all the stock in Rodgers

Q58: Describe the double taxation of income in

Q69: Jackson Corporation,not a dealer in securities,realizes taxable

Q106: Michael contributes equipment with a $25,000 adjusted