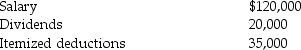

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

In addition,he received $40,000 from a relative for whom he had worked previously.You have researched whether the $40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classifying it as a gift.What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Definitions:

Ordinal Scale

The scale of measurement for a variable if the data exhibit the properties of nominal data and the order or rank of the data is meaningful. Ordinal data may be nonnumeric or numeric.

Interval Scale

The scale of measurement for a variable if the data demonstrate the properties of ordinal data and the interval between values is expressed in terms of a fixed unit of measure. Interval data are always numeric.

Ratio Scale

The scale of measurement for a variable if the data demonstrate all the properties of interval data and the ratio of two values is meaningful. Ratio data are always numeric.

Nominal Scale

The scale of measurement for a variable when the data are labels or names used to identify an attribute of an element. Nominal data may be nonnumeric or numeric.

Q7: What is the difference between the burden

Q27: Identify which of the following statements is

Q29: All of the following are advantages of

Q35: Identify which of the following statements is

Q35: Why are stock dividends generally nontaxable? Under

Q54: Briefly discuss some of the reasons for

Q81: For purposes of determining current E&P,which of

Q82: How does the use of a net

Q90: Upon formation of a corporation,its assets have

Q110: Section 351 applies to an exchange if