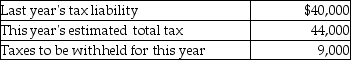

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits.Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty.Assume your client's adjusted gross income last year was $140,000.

Definitions:

Consumption

Utilization of products and services by household members.

Present Value

The contemporary estimate of a future monetary sum or cash flows, evaluated with a given return rate.

Investment Projects

Initiatives or plans undertaken by individuals or organizations to allocate resources with the expectation of generating future profits.

Budget Set

The collection of all possible bundles of goods and services that a consumer can afford given their income and the prices of goods.

Q4: Phil transfers $50,000 to a revocable trust

Q25: On April 15,2010,a married couple filed their

Q26: The Williams Trust was established six years

Q26: The IRS provides advice concerning an issue

Q31: Money Corporation has the following income and

Q39: To avoid the accumulated earnings tax,a corporation

Q44: Identify which of the following statements is

Q45: The statute of limitations is unlimited for

Q69: Identify which of the following statements is

Q78: Pressley Corporation was incorporated on January 1,2004.The