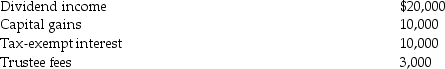

A trust reports the following results:  All of the items above are allocated to income.Calculate the maximum amount of trustee fees that are deductible.

All of the items above are allocated to income.Calculate the maximum amount of trustee fees that are deductible.

Definitions:

Hypertension

A medical condition in which the blood pressure in the arteries is persistently elevated, which can lead to serious health issues like heart disease.

Heart Disease

A range of conditions that affect the heart, including blood vessel diseases, heart rhythm problems, and heart defects.

Fatigue

Fatigue is a state of extreme tiredness or exhaustion, resulting from mental or physical exertion or illness.

Paradoxical Sleep

Another term for REM (Rapid Eye Movement) sleep, a phase of sleep characterized by dream activity, muscle paralysis, and rapid movement of the eyes.

Q3: Miller Corporation has gross income of $100,000,which

Q10: Grantor trusts are taxed as complex trusts.

Q26: On December 31,Kate sells her 20% interest

Q27: Corporations may deduct the adjusted basis of

Q47: Van owns all 1,000 shares of Valley

Q50: Identify which of the following statements is

Q55: Andy owns 20% of North Corporation and

Q56: Which of the following is valid reason

Q78: Identify which of the following statements is

Q80: Dallas Corporation,not a dealer in securities,realizes taxable