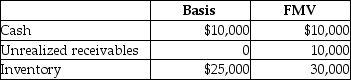

The XYZ Partnership owns the following assets on December 31:  A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash.XYZ Partnership has no liabilities.His recognized gain is

A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash.XYZ Partnership has no liabilities.His recognized gain is

Definitions:

Q13: Steve gave stock with an adjusted basis

Q20: A trust that is required to distribute

Q32: A husband transfers $90,000 by gift directly

Q41: Jeff owns 50% of an S corporation's

Q50: The exemption amount for an estate is<br>A)$0.<br>B)$100.<br>C)$300.<br>D)$600.

Q60: Identify which of the following statements is

Q68: Larry,the CEO of Caltech Corp.,has convinced his

Q84: A trust has the following results: <img

Q84: Identify which of the following statements is

Q100: Which regulation deals with Code Section 165?<br>A)Reg.Sec.1.165-5<br>B)Reg.Sec.165.183-5<br>C)Reg.Sec.1.5-165<br>D)Reg.Sec.165-5