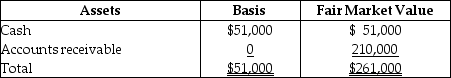

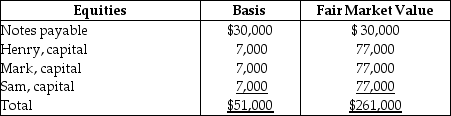

The HMS Partnership,a cash method of accounting entity,has the following balance sheet at December 31 of last year:

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Tap Water Enema

A medical procedure where tap water is introduced into the colon through the rectum to induce bowel movements.

Fecal Impaction

A serious condition in which hard, dry masses of stool become stuck in the colon or rectum, leading to blockage and requiring medical treatment.

Digital Removal

Digital removal refers to the manual extraction of feces from the rectum, a procedure sometimes necessary for patients with severe constipation or impaction.

Least Formed Stool

Describes stool that is typically more liquid than solid, often indicating gastrointestinal issues or infections.

Q2: Kristin,who works at a travel agency,had made

Q14: Which of the following is a characteristic

Q19: Which of the following examples illustrates the

Q26: On December 31,Kate sells her 20% interest

Q34: When a retiring partner receives payments that

Q78: Identify which of the following statements is

Q80: Which of the following is a pull

Q82: In the current year,Cesar,who is single,gives $26,000

Q86: Does Title 26 contain statutory provisions dealing

Q100: The alternate valuation date is generally<br>A)3 months