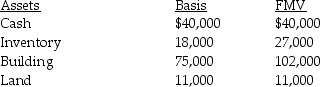

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:  The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Intellectual Property Law

The area of law that deals with protecting the rights of creators of original works, including inventions, designs, and artistic works.

Integrated Circuit

A compact electronic device that contains many interconnected transistors and other components on a single semiconductor substrate.

Napster Trial

A landmark legal case involving the peer-to-peer file-sharing service Napster, focusing on copyright infringement issues.

Ownership Of Copyright

pertains to the legal right granted to the creator of original work, providing them exclusive authority over the use, distribution, and adaptation of that work.

Q15: A tax case cannot be appealed when

Q23: Betty dies on February 20,2013.Her estate consisted

Q25: Larry,Steve's supervisor,has stopped responding to Steve's constant

Q49: A _ strategy refers to increasing profit

Q49: Identify which of the following statements is

Q59: The gift tax is a wealth transfer

Q66: Even if the termination of an S

Q74: A trust is required to distribute all

Q84: Susan contributed land with a basis of

Q89: Briefly describe the job characteristics model.