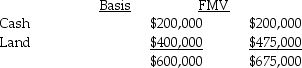

Sean,Penelope,and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000.In the following year,Penelope sold her one-third interest to Pedro for $225,000.At the time of the sale,the SPJ partnership had the following balance sheet:  Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Definitions:

Inherited Problem

An inherited problem refers to a condition or disease that is passed from parents to offspring through genes, affecting the health or physical traits of the individual.

Mood Disorders

Mental health conditions that primarily affect a person's emotional state, such as depression or bipolar disorder.

Biological Predisposition

An inherent inclination or susceptibility to a particular condition or disease based on genetic makeup.

Electrolyte Disorders

Medical conditions characterized by imbalances in the levels of electrolytes in the body, which can affect various bodily functions.

Q23: Describe briefly the types of organizational change

Q36: In February of the current year,Tom dies.Two

Q38: The value of stock that is not

Q42: The personal exemption available to a trust

Q58: Greg transfers property on August 8 of

Q63: Which of the following explains the difference

Q65: A client wants to take a tax

Q74: A trust is required to distribute all

Q80: Ron,the CEO of Tristin Corp.,has built the

Q91: The total bases of all distributed property