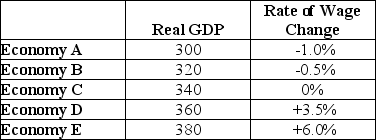

The table below shows data for five economies of similar size.Real GDP is measured in billions of dollars.Assume that potential output for each economy is $340 billion.  TABLE 24-1 Refer to Table 24-1.Consider Economy E.Which of the following best describes the positions of the aggregate demand and aggregate supply curves in this economy?

TABLE 24-1 Refer to Table 24-1.Consider Economy E.Which of the following best describes the positions of the aggregate demand and aggregate supply curves in this economy?

Definitions:

Public Offering Price

The price at which new issues of stocks or bonds are offered to the public by an issuer for the first time.

Spread

The difference between two prices or rates, such as the bid and ask price of a stock, or the interest rates of two different investments.

Yield to Maturity

The total return anticipated on a bond if the bond is held until it matures, including both interest payments and capital gains.

Bond Indenture

A legal and binding contract between a bond issuer and the bondholders, specifying the terms of the bond such as the interest rate, maturity date, and other conditions.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7713/.jpg" alt=" FIGURE 23-5 Refer

Q16: The "transactions demand" for money arises from

Q17: Which of the following is a defining

Q23: Suppose the Canadian economy had an inflationary

Q37: Which of the following is a benefit

Q82: Consider the supply of and demand for

Q88: Consider the nature of macroeconomic equilibrium.If,at a

Q111: The AD curve relates the price level

Q116: The aggregate supply curve tends to be

Q133: Consider the AD/AS macro model.The study of