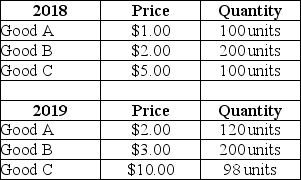

The table below shows total output for an economy over 2 years.  TABLE 20-5 Refer to Table 20-5.The implicit GDP deflator in 2019,when 2018 is used as the base year,was approximately

TABLE 20-5 Refer to Table 20-5.The implicit GDP deflator in 2019,when 2018 is used as the base year,was approximately

Definitions:

Average Tax Rate

The portion of total income that is paid as taxes, calculated by dividing the total amount of taxes paid by the total income.

Tax Liability

The total amount of tax that an individual or business owes to the government, based on their income or revenue.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, representing the percentage of tax applied to your income for each tax bracket in which you qualify.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), showing the percentage of income or spending that goes to taxes.

Q19: When calculating GDP from the expenditure side,G<sub>a</sub>

Q22: The aggregate expenditure (AE)function is an upward-sloping

Q25: In the study of short-run fluctuations in

Q36: With a budget of $200 million,the government

Q40: Consider the following information describing a closed

Q84: Consider the basic AD/AS model with an

Q85: The table below provides macroeconomic data for

Q106: Consider the simplest macro model with a

Q108: Consider the global market for some mineral,X.In

Q129: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7713/.jpg" alt=" FIGURE 21-3 Refer