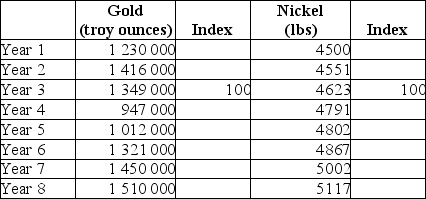

The table below shows hypothetical data for the volume of gold and nickel output across several years.  TABLE 2-5 Refer to Table 2-5.What is the index number for gold output in Year 1?

TABLE 2-5 Refer to Table 2-5.What is the index number for gold output in Year 1?

Definitions:

CAPM

The Capital Asset Pricing Model, a model that describes the relationship between systemic risk and expected return for assets, particularly stocks.

Risk-Return Relationship

The principle that potential return increases with an increase in risk, describing the trade-off between the desire for the lowest possible risk and the highest possible return.

APT

Arbitrage Pricing Theory, a model that predicts the expected return of a financial asset based on its sensitivities to macroeconomic factors.

Risk Premiums

The extra return expected by investors for holding a risky investment instead of a risk-free asset.

Q10: The demand and supply schedules for a

Q27: In Shoetown,a rancher takes $0 worth of

Q36: You can help your group collaborate and

Q39: The table below shows hypothetical data for

Q43: Consider the following information describing a closed

Q51: When group members use different meanings for

Q61: Suppose an individual wheat farmer's income is

Q62: Which poor listening habit occurs when a

Q66: Groupmemberswho say"Itjustfeelslike the rightthingtodo"aremostlikely usingthe decision-making style.<br>A)rational<br>B)intuitive<br>C)dependent<br>D)avoidant<br>E)spontaneous

Q72: Consider the following information for an economy