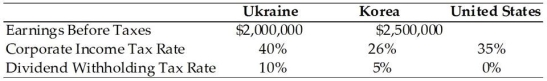

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea pays out 50% of its earnings from each subsidiary, what are the additional U.S. taxes due on the foreign sourced income from the Ukraine and Korea respectively?

Definitions:

Administrative Expenses

Costs related to the general operation of a business that are not directly linked to production or sales, such as salaries of office staff and utilities.

Cash Disbursements

The payments a company makes during a period, including expenses, debt payments, and purchase of assets.

Manufacturing Overhead

Indirect factory-related costs that are incurred when producing a product, including costs associated with maintenance, utilities, and quality control.

Fixed Selling Expenses

Fixed selling expenses are those costs associated with selling a product that do not change with the level of production or sales, such as salary of sales staff and rent for office space.

Q3: Which of the following are types of

Q5: Of the following,which would NOT be considered

Q14: A letter of credit is an agreement

Q14: Self-leadership involves strategies that help individuals understand:<br>A)what

Q22: Having control over your own lives,including where

Q23: In the case of international trade,the risk

Q40: Refer to Instruction 10.1.CVT chooses to hedge

Q40: An example of economies of scale in

Q48: Strategic alliances are normally formed by firms

Q49: One way a nation can improve its