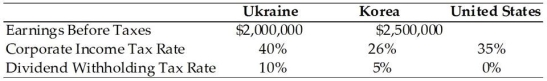

TABLE 15.1

Use the information to answer following question(s) .

BayArea Designs Inc., located in Northern California, has two international subsidiaries, one located in the Ukraine, the other in Korea. Consider the information below to answer the next several questions.

-Refer to Table 15.1. If BayArea set the payout rate from the Ukraine subsidiary at 25%, how should BayArea set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill?

Definitions:

Ordinary Skills

The average level of competency, expertise, or ability that can be reasonably expected from a professional or practitioner in a specific field.

Patent Applicant

An individual or entity that applies for legal protection of an invention or process through the patent office, seeking exclusive rights to use and profit from that invention.

Exclusive Federal Jurisdiction

Jurisdiction granted solely to federal courts in certain types of cases, meaning state courts do not have jurisdiction over these matters.

First-To-File

A principle in patent law where the first person to file a patent application for an invention is granted the patent, regardless of who first invented the item.

Q5: Which one of the following management techniques

Q8: As economic conditions continued to deteriorate in

Q8: Theoretically,most MNEs should be in a position

Q22: It is highly unusual for a multinational

Q23: In the case of international trade,the risk

Q38: Eurocredits are:<br>A)bank loans to MNEs and others

Q40: Distinguish between behaviors that take place at

Q44: What are the main types of political

Q55: Transfer pricing is a strategy that may

Q59: Private equity funds appear to have a