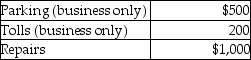

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Definitions:

Human Papillomavirus (HPV)

A group of viruses that can cause genital warts and are associated with the risk of developing several types of cancer.

Risk Factor

Any attribute, characteristic, or exposure that increases the likelihood of developing a disease or injury.

Testicular Cancer

A type of cancer that originates in the testicles, the male reproductive glands; it is one of the most treatable and curable cancers when detected early.

White Men

A demographic group defined by race (white) and gender (male), often examined in socio-political and cultural contexts.

Q11: Wang, a licensed architect employed by Skye

Q26: During puberty,levels of _ increase much more

Q34: Billy and Sue are married and live

Q42: What two conditions are necessary for moving

Q70: Matt paid the following taxes in 2014:

Q73: Deductions for adjusted gross income include all

Q112: Expenditures incurred in removing structural barriers in

Q131: Kim currently lives in Buffalo and works

Q132: Edward incurs the following moving expenses: <img

Q134: If an individual is not "away from