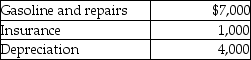

Jordan, an employee, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Lawn Quality

The condition or status of a lawn, typically assessed based on its color, density, uniformity, and freedom from pests and diseases.

Regression Analysis

A statistical process for estimating the relationships among variables, often used to forecast or predict outcomes.

Prediction Interval

A range of values that is likely to include the outcome of a single future observation based on a predictive model, given a certain level of confidence.

Typing Speed

The measure of how fast an individual can type, often recorded as words per minute (WPM).

Q1: If you had to choose a single

Q18: In the case of casualty losses of

Q21: A large high school may have many

Q42: Two separate business operations conducted at the

Q46: For charitable contribution purposes, capital gain property

Q46: According to Robert LeVine,in raising children,families implicitly

Q51: Adolescents from a minority ethnic background may

Q57: An employer-employee relationship exists where the employer

Q76: All of the following are true with

Q111: Super Development Company purchased land in the