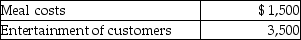

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Definitions:

Millimeter

A unit of length in the metric system equal to one thousandth of a meter.

Abbreviation

A shortened form of a word or phrase used to simplify communication.

Castings

The process of pouring liquid metal into a mold, where it solidifies into a specific shape.

Material

The substance or substances out of which an object or item is made, which can influence its properties and usage.

Q7: Adolescents who frequently engage in bullying<br>A)are generally

Q14: If property that qualifies as a taxpayer's

Q15: Today's IQ tests are standardized to give

Q21: In 2013 Grace loaned her friend Paula

Q41: Donald sells stock with an adjusted basis

Q43: Susanna is socially immature,withdrawn,and fearful.She is likely

Q44: _ is the web of social and

Q46: Aretha has AGI of less than $100,000

Q60: Vanessa owns a houseboat on Lake Las

Q79: Van pays the following medical expenses this