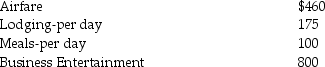

Richard traveled from New Orleans to New York for both business and vacation. He spent 4 days conducting business and some days vacationing. He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor), assuming Richard is an employee and is not reimbursed, under the following two circumstances?

a. He spends three days on vacation, in addition to the business days.

b. He spends six days on vacation, in addition to the business days.

Definitions:

Sick Pay

Compensation paid to employees when they are unable to work due to illness.

Child Support Payments

Payments made by a non-custodial parent to support their child or children; these are not tax-deductible.

Original Issue Discount

The difference between the par value (or face value) of a bond and the lower price at which it is originally sold, which effectively represents interest paid to the bondholder.

Interest Income

Income earned from the lending of funds or depositing money in interest-bearing accounts.

Q3: Sacha, a dentist, has significant investment assets.

Q7: Taxpayers are allowed to recognize net passive

Q19: Under a qualified pension plan, the employer's

Q22: Matthew wants to be an educated consumer

Q28: Monitoring a child's behaviour and structuring daily

Q30: According to John Bowlby,experiences in infancy lead

Q50: On July 31 of the current year,

Q50: As a community leader,Mr.Mandela wants to encourage

Q53: In a nomination study of social status,a

Q98: During 2014 and 2015, Danny pays property