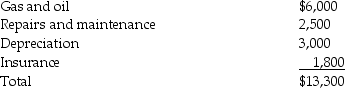

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles. She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Definitions:

Vet

A professional who practices veterinary medicine, treating diseases, disorders, and injuries in animals.

Christmas Presents

Gifts or items given to others during the Christmas holiday as a sign of affection, goodwill, or celebration.

Beer

A fermented alcoholic beverage made from barley, hops, water, and yeast.

Lexical

Pertaining to the words or vocabulary of a language.

Q5: Kurt Fischer's approach to cognitive development differs

Q18: "Until the 20th century,there were no teenagers,only

Q36: Cultural beliefs about how children should be

Q45: When Brandon was 14,his parents separated and

Q65: In a contributory defined contribution pension plan,

Q68: Which of the following conditions would generally

Q85: In a defined contribution pension plan, fixed

Q101: Gertie has a NSTCL of $9,000 and

Q107: What is the treatment of charitable contributions

Q107: Ron is a university professor who accepts