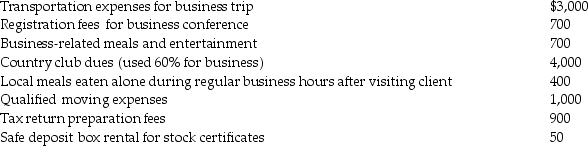

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unreimbursed unless otherwise indicated:

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Communication Tool

A medium or channel through which information or messages are transmitted to target audiences.

Eco-efficiency

Achieving economic efficiency in business while minimizing negative environmental impacts.

Environmental Cost Leadership

A business strategy focused on becoming the market leader by implementing cost-saving environmental practices, thus offering competitively priced goods or services while minimizing ecological impacts.

Corporate Social Responsibility

A business model that helps a company be socially accountable to itself, its stakeholders, and the public.

Q15: Joy reports the following income and loss:

Q24: Assessments made against real estate for the

Q28: The fact that Canadian teens spend so

Q34: Alex is a self-employed dentist who operates

Q40: Assessments or fees imposed for specific privileges

Q42: Jocks,Brains,and Druggies are examples of _ that

Q48: What important health issues come forward during

Q54: Sarah had a $30,000 loss on Section

Q100: Edward purchased stock last year as follows:

Q106: Jill is considering making a donation to