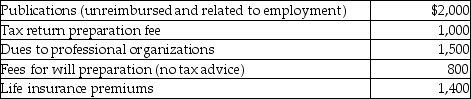

West's adjusted gross income was $90,000. During the current year he incurred and paid the following:  Assuming he can itemize deductions, how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Assuming he can itemize deductions, how much should West claim as miscellaneous itemized deductions (after limitations have been applied) ?

Definitions:

State Law

Legislation that is enacted and enforced by a state's legislative body, governing matters not reserved to the federal government by the Constitution.

Contract Clause

A provision in the U.S. Constitution that prohibits states from passing any law that impairs the obligation of contracts, aiming to protect contractual agreements from state interference.

Minimum Wage Law

Legislation establishing the lowest hourly wage that employers can legally pay their workers.

Unconstitutional

Something that does not conform to the principles or rules set out in a country's constitution, rendering it invalid or unenforceable.

Q4: Normally, a security dealer reports ordinary income

Q14: Typically,boys experience their first ejaculation fairly _

Q18: Research on trends in puberty often focuses

Q23: In Professor Bilgrim's research project,teens from India,Turkey,and

Q27: Kwame is wondering how to get closer

Q34: What is or are the standards that

Q62: Corporate charitable deductions are limited to 10%

Q82: Doug pays a county personal property tax

Q100: Hugh contributes a painting to a local

Q124: A partnership plans to set up a