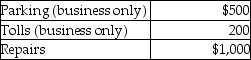

Chelsea, who is self-employed, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Chelsea has an AGI for the year of $50,000. Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations, she can deduct

Chelsea has an AGI for the year of $50,000. Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations, she can deduct

Definitions:

Operating Activities

Activities directly related to the core business operations, including cash flows from sales, services, and the costs of doing business, reflected on a company's cash flow statement.

Income Taxes

Taxes levied by the government on the income generated by individuals or entities.

Indirect Method

A way of calculating cash flow from operating activities by starting with net income and adjusting for changes in non-cash balance sheet items.

Financing Activities

Transactions that involve raising funds for the company, including issuing debt, issuing equity, and paying dividends.

Q2: Olga's mother sets strict rules and punishes

Q9: Charles is a single person, age 35,

Q14: Paulo attends a school with a lot

Q27: Adolescents are more likely to come into

Q46: According to Robert LeVine,in raising children,families implicitly

Q51: During prenatal development,the hormone testosterone<br>A)is present in

Q85: Justin has AGI of $110,000 before considering

Q101: Losses on sales of property between a

Q101: One of the requirements which must be

Q129: Melody inherited 1,000 shares of Corporation Zappa