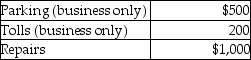

Brittany, who is an employee, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Brittany's AGI for the year of $50,000, and her employer does not provide any reimbursement. She uses the standard mileage rate method. After application of any relevant floors or other limitations, Brittany can deduct

Definitions:

Q5: On a personality test,Kim scores high in

Q22: A developmental systems account would point to

Q24: Girls who see themselves as overweight,even when

Q29: Which of the following is NOT one

Q34: Billy and Sue are married and live

Q44: In general, the deductibility of interest depends

Q47: A discussion of adolescent thinking that features

Q49: If an NOL is incurred, when would

Q101: A personal property tax based on the

Q121: Interest incurred during the development and manufacture