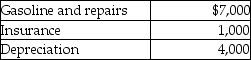

Rajiv, a self-employed consultant, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Morals

Pertaining to distinction of “right” and “wrong.”

Standards Of Conduct

Ethical and professional guidelines that govern behavior in a specific context or profession.

Professional Ethics

Moral principles that govern the behavior of professionals in their fields.

Knowledge And Skills

The combination of theoretical understanding and practical abilities that an individual possesses.

Q1: A school environment that stresses competition and

Q3: A taxpayer can deduct a reasonable amount

Q6: Joe is a self-employed tax attorney who

Q6: Ms.Gomez,who teaches 10th grade history,is warm and

Q12: According to gender schema theorists,a child's sense

Q36: All of the following may deduct education

Q37: Bad debt losses from nonbusiness debts are

Q40: Characteristics of profit-sharing plans include all of

Q48: The fastest growing cities in the world

Q81: If stock sold or exchanged is not