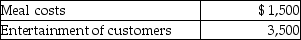

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Definitions:

Variable

Measurable factor or characteristic that can vary within an individual, between individuals, or both.

Dependent Variable

In experimental and statistical research, the variable being tested and measured, which is expected to change as a result of manipulations to the independent variable.

Hypothesis

Testable statement about two or more variables and the relationship between them.

Scientific Method

A systematic approach to research where a problem is identified, relevant data are gathered, a hypothesis is formulated from the data, and the hypothesis is empirically tested.

Q13: _ percent of the Canadian population is

Q15: Pamela was an officer in Green Restaurant

Q18: Sexual relationships on television generally<br>A)are between young

Q18: "Until the 20th century,there were no teenagers,only

Q24: Two friends are arguing about the origins

Q25: Going along with antisocial behaviour by peers

Q32: Where conformity to traditional gender roles is

Q39: When Patrick is asked what his background

Q48: What important health issues come forward during

Q49: For the years 2010 through 2014 (inclusive)Mary,