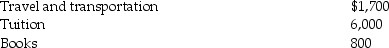

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a. If Ellie is self-employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by his employer, what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Venue Questions

Legal issues regarding the most appropriate location or jurisdiction where a trial should be held.

Forum Selection Clauses

Provisions in a contract that designate the specific court or jurisdiction where disputes will be resolved.

Service of Process

The procedure by which a party to a lawsuit gives an appropriate notice of initial legal action to another party, court, or administrative body in an effort to exercise jurisdiction over that person so as to enable that person to respond to the proceeding before the court, body, or other tribunal.

In Rem Jurisdiction

A legal principle that allows a court to exercise jurisdiction over a particular piece of property, regardless of who owns the property or where the owner is located.

Q1: Business investigation expenses incurred by a taxpayer

Q9: Prof.Nathanyahu says that the changes in thinking

Q13: Schools in which the curriculum and teaching

Q16: The working models of the self and

Q28: During puberty,the HPG axis sets in motion

Q32: Persistent class and ethnic differences in children's

Q43: Investment interest includes interest expense incurred to

Q52: What are the different ways adolescents who

Q100: A bona fide debtor-creditor relationship can never

Q127: If an employee incurs business-related entertainment expenses