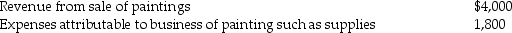

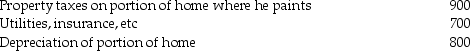

Dighi, an artist, uses a room in his home (250 square feet)as a studio exclusively to paint. The studio meets the requirements for a home office deduction. (Painting is considered his trade or business.)The following information appears in Dighi's records:

Expenses related to home office:

Expenses related to home office:

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(a)What is the amount of Dighi's home office deduction if he is self-employed?

(b)If some amount is not allowed under the tax law, how is the disallowed amount treated?

(c)Assume all of Dighi's records of expenses relating to the room were destroyed in a major paint spill. How much of a home office deduction, if any, will he be allowed?

Definitions:

Social Anxiety Disorder

A mental health disorder characterized by significant anxiety or fear of being judged, negatively evaluated, or rejected in a social or performance situation.

Blindsight

A condition where an individual can respond to visual stimuli without consciously perceiving them, typically following brain damage.

Visual Perception Track

The process and pathways by which visual information is received, interpreted, and integrated in the brain.

Visual Action Track

Also known as the dorsal stream, it is a pathway in the brain that is involved in the processing of movement and spatial location.

Q1: If you had to choose a single

Q2: The four (4)causal factors that are particularly

Q5: During adolescence,siblings who are close in age

Q48: Patrick and Belinda have a twelve year

Q50: Chandra was born in India but now

Q58: Educational expenses incurred by a bookkeeper for

Q65: In a contributory defined contribution pension plan,

Q99: Various criteria will disqualify the deduction of

Q99: If a medical expense reimbursement is received

Q111: Daniel has accepted a new job and